Microfinance

A female-oriented approach to Micro-finance.

We have an active loan amount of 359,786,978/- PKR which has been distributed among 29,523 people (95% women) making an average amount of 12,187 PKR per loan.

95% of our borrowers are women.

Brief:

The Microfinance sector in Pakistan consists of around 50 institutions offering microfinance services. It has around 3.1 million active borrowers which is reflective of how the microfinance industry has significant potential for growth. The microfinance sector is diverse, as it ranges from small to large institutions performing operations on a rural and urban scale. Moreover, numerous studies show that women are considered to be the most reliable borrowers as they repay their loans in due time. Microfinancing schemes empower women from low-income families, as it encourages them to receive quality education for her and her children. This ultimately leads to a better lifestyle for both the woman and her family.

What We Do:

Bunyad realizes that poverty in impoverished areas is rooted in the illiteracy and underdevelopment of women. The youth faces an alarming rate of unemployment, women being the victims of economic inequality due to being denied property rights or being recognized for their domestic work. In addition to this, if someone has the skills to combat his/her poverty, they lack the resources in order to do so. Bunyad recognized this issue and launched its microfinance program in 1998. Over the years, it has turned into a major programme due to how it gave a means of livelihood to women from low-income backgrounds. To date, BUNYAD Foundation has an active loan amount of 359,786,978 PKR which has been distributed among 29,523 people (95% women) making an average amount of 12,187 PKR per loan. The loan amount ranges between 10,000 PKR to 50,000 PKR. Bunyad has requirements that have to be met in order to qualify for receiving the said loan. The aforementioned criteria comply with standardized compliance procedures and protocols, resulting in a 90% recovery rate of the loans borrowed.

Geographic Coverage:

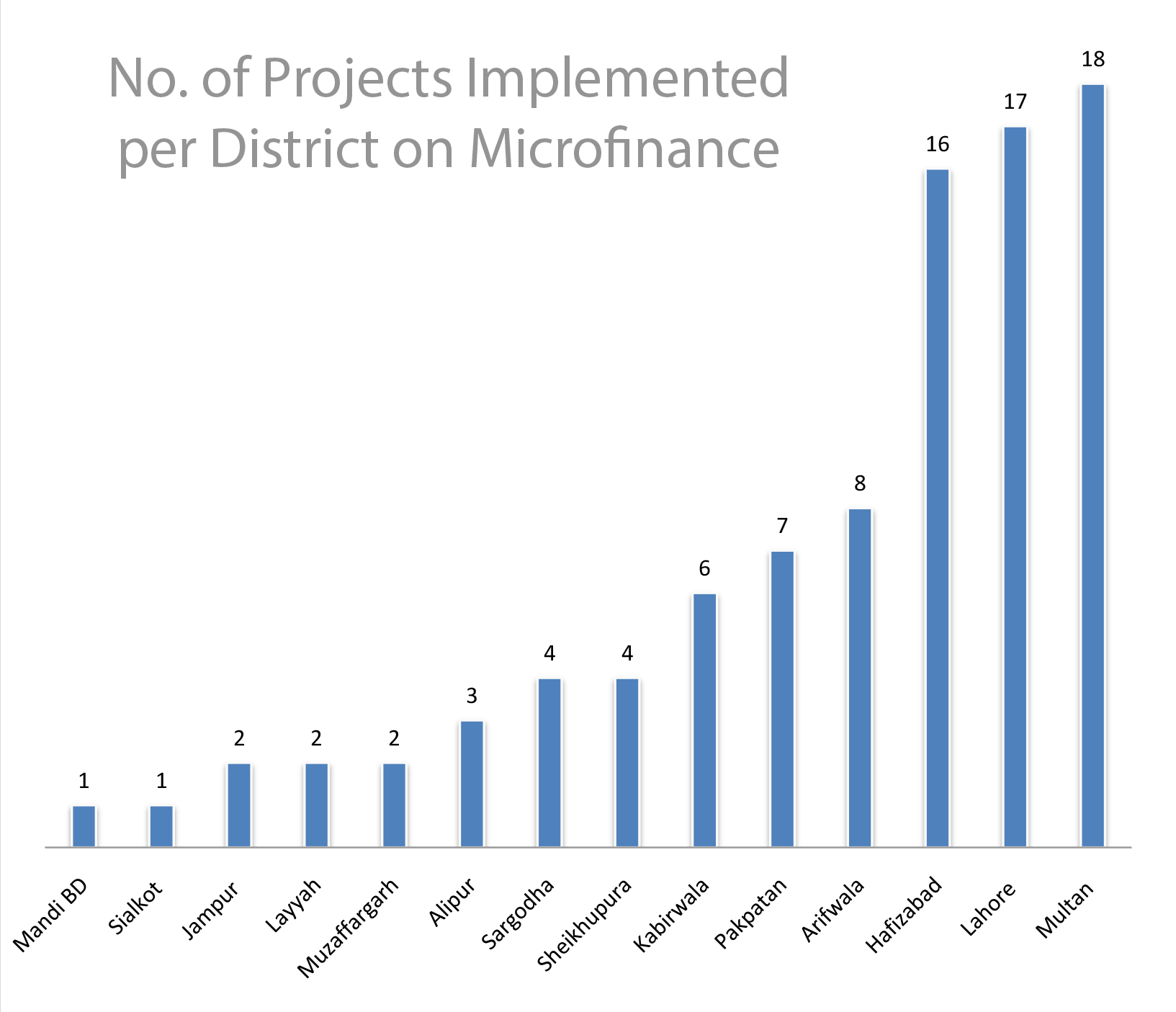

The microfinance program of Bunyad foundation is its second largest program after its literacy and non-formal basic education programmes. It has active clients in 14 districts of Punjab, including Multan, Lahore, and Hafizabad. Around 18,17 and 16 microfinance projects have taken place in the aforementioned cities, implemented by the help of community activists. Each project has been implemented in 6-7 districts.

Partners:

Pakistan Poverty Alleviation Fund (PPAF) is the leading partner of BUNYAD Foundation and it supports its microfinance program which has financed 81% of total microfinance budget, i.e. 303,339,038 PKR. The remaining 19%, i.e. 56,447,940 PKR, has been financed by the Women Development Division, Khush’Haali Bank Pvt. Limited, and Orix Leasing.